Investing can feel like navigating a minefield – one wrong step and your hard-earned money could vanish. But understanding different investment vehicles is your map to safer travels. In this comprehensive guide, we’ll explore 18 investment options from the most volatile to the safest, complete with real-life stories of investors who learned valuable lessons the hard way (so you don’t have to).

1. Futures and Commodities: Profits on a Razor’s Edge

Risk Level: Highest

Futures and commodities trading is like walking a financial tightrope—one misstep can cost you everything. These contracts obligate buyers and sellers to transact assets like oil, wheat, or metals at a set price on a future date. Because they’re highly leveraged, small price swings can lead to massive gains—or devastating losses.

Carlos’s Costly Gamble & Recovery

Carlos Rodriguez, a restaurant owner in Chicago, thought he was hedging smartly by locking in wheat prices through futures contracts. But when a historic drought sent wheat prices soaring 300%, his $50,000 position triggered $150,000 in margin calls—nearly bankrupting his family business.

How He Recovered:

- Negotiated payment terms with his broker to avoid liquidation

- Switched to fixed-price supplier contracts to reduce exposure

- Now uses options for more controlled, limited-risk hedging

Key Lesson: Futures are not for the faint of heart. They’re powerful tools—but best left to professionals who can stomach the volatility and cover the margin

2. Speculative Stocks: The Startup Lottery

Risk Level: Very High

Speculative stocks are shares in early-stage or unproven companies, often in emerging industries like biotech or AI. While they offer the potential for explosive growth, they also carry a high risk of total loss.

The Thompson Twins’ Tech Dream Gone Wrong

Jake and Emily Thompson invested $25,000 in a buzzy biotech startup’s IPO. The stock tripled in weeks—but when the company failed to deliver on its breakthrough drug, shares crashed 90%, wiping out most of their investment.

Their New Approach:

- Capped speculative investments at 5% of their portfolio

- Chose diversified venture capital funds instead of single stocks

- Set 25% stop-loss orders to limit downside

Takeaway: Chasing the next big thing can be thrilling—but never risk more than you can afford to lose.

3. Gold and Collectibles: Shiny but Risky

Risk Level: High

Physical assets like gold, rare coins, or fine art don’t generate income and rely entirely on market demand. They can be hard to sell quickly and often come with high transaction costs.

Uncle Frank’s Coin Collection Disaster

Frank spent decades building a $100,000 rare coin collection for retirement. But when he needed cash, dealers offered just $55,000—and there was no quick way to get better offers.

His Solution:

- Sold pieces gradually through reputable auction houses

- Reinvested 70% into dividend-paying stocks, 30% into gold ETFs

- Now treats collectibles as hobbies, not financial assets

Lesson: Value is in the eye of the buyer—don’t count on collectibles for liquidity.

4. Limited Partnerships: Risky Business

Risk Level: High

Limited partnerships (LPs), such as those in oil drilling or real estate, promise high returns but often come with hidden risks, including lack of liquidity and potential personal liability.

The Harrisons’ Oil Nightmare

After investing $50,000 in a private oil LP, the Harrisons lost their entire investment when oil prices collapsed. Worse, they were hit with a $20,000 bill for environmental cleanup due to their liability as limited partners.

How They Bounced Back:

- Hired a tax attorney to negotiate their liability

- Switched to publicly traded MLPs (Master Limited Partnerships)

- Capped energy investments at 5% of their net worth

Key Insight: Always read the fine print—especially when it comes to liability.

5. Real Estate Options: High-Risk Gambles

Risk Level: High

Real estate options give you the right—but not the obligation—to buy property at a set price in the future. If the market turns or zoning laws change, your entire investment can vanish.

Lisa’s $10,000 Lesson

Lisa paid $10,000 for an option to buy commercial land. But a surprise zoning change made the property unusable for her intended project—rendering the option worthless.

Her Comeback Strategy:

- Partnered with experienced developers

- Only pursued properties with multiple potential uses

- Always structured options through an LLC

Lesson: Real estate options offer leverage—but only if you control the variables.

6. Blue Chip Stocks: The Steady Performers

Risk Level: Moderate to High

Blue chip stocks are shares in large, established companies with strong reputations, like Johnson & Johnson or Coca-Cola. They offer steady growth and dividends, but can still face short-term volatility.

Grandpa Joe’s Winning Strategy

When J&J faced lawsuits and shares dropped 25%, Joe didn’t panic. He held firm—and even bought more.

His Approach:

- Maintained his core position in blue chips

- Added healthcare ETFs for broader exposure

- Sold covered calls to generate income during the dip

Takeaway: Quality companies can weather storms—if you stay patient and disciplined.

7. Growth Mutual Funds: The Rollercoaster Ride

Risk Level: Moderate

Growth mutual funds invest in fast-growing companies, offering high return potential—but also sharp declines during market corrections.

The Millers’ College Fund Panic

The Millers had $35,000 in a tech-focused growth fund for their child’s college. Just as tuition bills arrived, the fund dropped to $22,000.

Their Solution:

- Shifted to target-date funds for better risk alignment

- Took low-interest education loans to bridge the gap

- Now move funds to bonds three years before they’re needed

Lesson: Match your investment risk to your timeline—especially for big life events.

8. Balanced Funds: The Middle Ground

Risk Level: Moderate

Balanced funds typically hold a 60/40 mix of stocks and bonds, offering a blend of growth and stability. They’re great for hands-off investors—but may not suit every goal.

Sarah’s Retirement Wake-Up Call

At 55, Sarah realized her 60/40 allocation wouldn’t support her plan to retire early. A 60/40 allocation refers to a portfolio mix where 60% of the investments are in stocks (equities), and 40% are in bonds (fixed-income securities).

Her Adjustment:

- Created a 5-year cash “bucket” for near-term expenses

- Shifted the rest to a 70/30 allocation for more growth

- Added a small annuity for guaranteed income

Key Insight: One-size-fits-all portfolios need customization as your goals evolve.

9. High-Grade Preferred Stock: Steady Income with a Twist

Risk Level: Low to Moderate

Preferred stocks pay fixed dividends and rank above common stock in bankruptcy, but they’re sensitive to interest rate changes and lack voting rights.

Mr. Chen’s Retirement Lifeline (Almost Cut)

Mr. Chen relied on preferred dividends from utilities and banks. When interest rates spiked, his holdings dropped 15% in value, shaking his confidence.

His Solution:

- Diversified into preferreds with staggered call dates

- Added floating-rate preferreds to hedge rate risk

- Balanced with dividend growth stocks for inflation protection

Lesson: Even “safe” income investments need active management.

10. High-Grade Convertible Securities: Bonds with a Growth Kick

Risk Level: Low to Moderate

Convertible bonds offer the safety of fixed income with the option to convert into stock if the company performs well—blending stability and upside.

The Parkers’ Tesla Windfall (and Near-Miss)

The Parkers invested $50,000 in Tesla convertible bonds. When the stock soared 700%, they converted half into shares. When it later dropped 50%, they were relieved the other half remained in bonds earning 5%.

Their Strategy:

- Used trailing stop orders to lock in gains

- Reinvested profits into new convertibles

- Bought protective puts to hedge against volatility

Takeaway: Convertibles offer flexibility—but timing and balance are everything.

Absolutely! Here’s a refined and elevated rewrite of Vehicles 11 through 18, keeping the original investment types and structure, but enhancing clarity, storytelling, and professionalism—just like we did for the earlier sections:

11. High-Grade Municipal Bonds: Tax-Free Haven

Risk Level: Low

Municipal bonds, or “munis,” are issued by state and local governments. They offer tax-free income, making them especially attractive to high-income investors. But changes in tax laws or local credit risks can affect returns.

The Johnsons’ Tax Shock (and Recovery)

As physicians in the 35% tax bracket, the Johnsons loaded up on muni bonds. But when federal tax laws changed, reducing their deductions, their after-tax returns took a hit.

Their Fix:

- Shifted a portion to U.S. Treasuries for added liquidity

- Added national muni bond funds for broader diversification

- Donated appreciated bonds to charity to avoid capital gains

Lesson: Tax advantages are great—until the rules change. Diversify and stay flexible.

12. Money Market Accounts: Cash with a Tiny Yield

Risk Level: Very Low

Money market accounts are FDIC-insured and offer slightly higher interest than savings accounts, with check-writing privileges. But they rarely keep up with inflation.

Maria’s Inflation Wake-Up Call

Maria kept $30,000 in a money market account for emergencies. Over five years, inflation quietly eroded 15% of its purchasing power.

Her Solution:

- Built a tiered emergency fund:

- $10,000 in money market (instant access)

- $15,000 in short-term T-bills (higher yield)

- $5,000 in I-bonds (inflation-protected)

Key Insight: Cash is safe—but not risk-free. Inflation is the silent thief.

13. High-Grade Corporate Bonds: Steady but Boring

Risk Level: Very Low

Issued by financially strong companies like Microsoft or Procter & Gamble, these bonds offer higher yields than government debt with relatively low risk.

The Browns’ Rising-Rate Dilemma

When interest rates rose, the value of the Browns’ bond holdings dropped. Panicked, they considered selling at a loss.

Their Strategy:

- Held bonds to maturity to avoid locking in losses

- Added floating-rate notes to benefit from rising rates

- Reinvested maturing bonds at higher yields

Lesson: Bond prices fluctuate—but quality bonds held to maturity still deliver.

14. FDIC-Insured CDs: Safety with a Lock

Risk Level: Minimal

Certificates of Deposit (CDs) offer guaranteed returns if you commit your money for a set term. But early withdrawals come with penalties, and rates may lag inflation.

Grandma Rosa’s Liquidity Crisis

Rosa had most of her savings in long-term CDs. When she needed funds for unexpected surgery, she faced stiff penalties to access her money.

Her Fix:

- Built a CD ladder with maturities every 6 months

- Added a no-penalty CD for emergencies

- Mixed in short-term Treasuries for added flexibility

Takeaway: Safety is good—but access matters. Ladder your CDs to stay liquid.

15. U.S. Savings Bonds: The Sleep-Easy Choice

Risk Level: Minimal

Series EE and I Bonds are backed by the U.S. government and offer tax-deferred growth. EE bonds double in 20 years; I Bonds adjust for inflation.

Luis’s College Shortfall

Luis’s parents saved with EE bonds, which doubled to \$40,000. But tuition had risen to $60,000—leaving a gap.

Their Adjustment:

- Used bonds for the first two years of college

- Luis worked as a teaching assistant for housing

- Shifted remaining savings into a 529 plan for tax-free growth

Lesson: Bonds are reliable—but not always enough. Combine them with other tools.

16. Insurance-Based Investments: Guarantees at a Cost

Risk Level: Low

Annuities and whole life insurance offer guaranteed income or death benefits. But they often come with high fees, limited flexibility, and inflation risk.

The Wilsons’ Inflation Problem

The Wilsons relied on a fixed annuity paying $2,000/month. Over time, inflation eroded its purchasing power.

Their Solution:

- Added an inflation-adjusted annuity for future years

- Bought a deferred annuity to kick in later in retirement

- Reviewed and renegotiated policy fees with their advisor

Key Insight: Guarantees are comforting—but inflation can quietly undo them.

17. Treasury Bills/Notes/Bonds: The Safest of Safe

Risk Level: Safest

U.S. Treasuries are backed by the federal government and considered virtually risk-free. They’re ideal for capital preservation—but offer modest returns.

The Smiths’ Too-Safe Portfolio

The Smiths had their entire retirement in Treasuries, earning just 2%. It wasn’t enough to keep up with their lifestyle needs.

Their Fix:

- Allocated 20% to TIPS (inflation-protected securities)

- Used a “bond tent” strategy—more bonds early, fewer later

- Added dividend-paying stocks for modest growth

Lesson: Safety is essential—but too much can cost you in the long run.

18. FDIC Checking/Savings: The Foundation, Not the Fortress

Risk Level: Zero

FDIC-insured checking and savings accounts are the ultimate safe zone—ideal for emergency funds and short-term needs. But they offer little to no growth.

Jen’s Cash Drag

Jen kept $15,000 in a traditional savings account earning 0.01%. Over five years, inflation quietly chipped away at its value.

Her Upgrade:

- Kept 3 months of expenses in checking

- Moved 6 months to a high-yield savings account

- Invested the rest in Treasury money market funds

Final Lesson: Even your safest money needs a strategy. Don’t let cash sit idle.

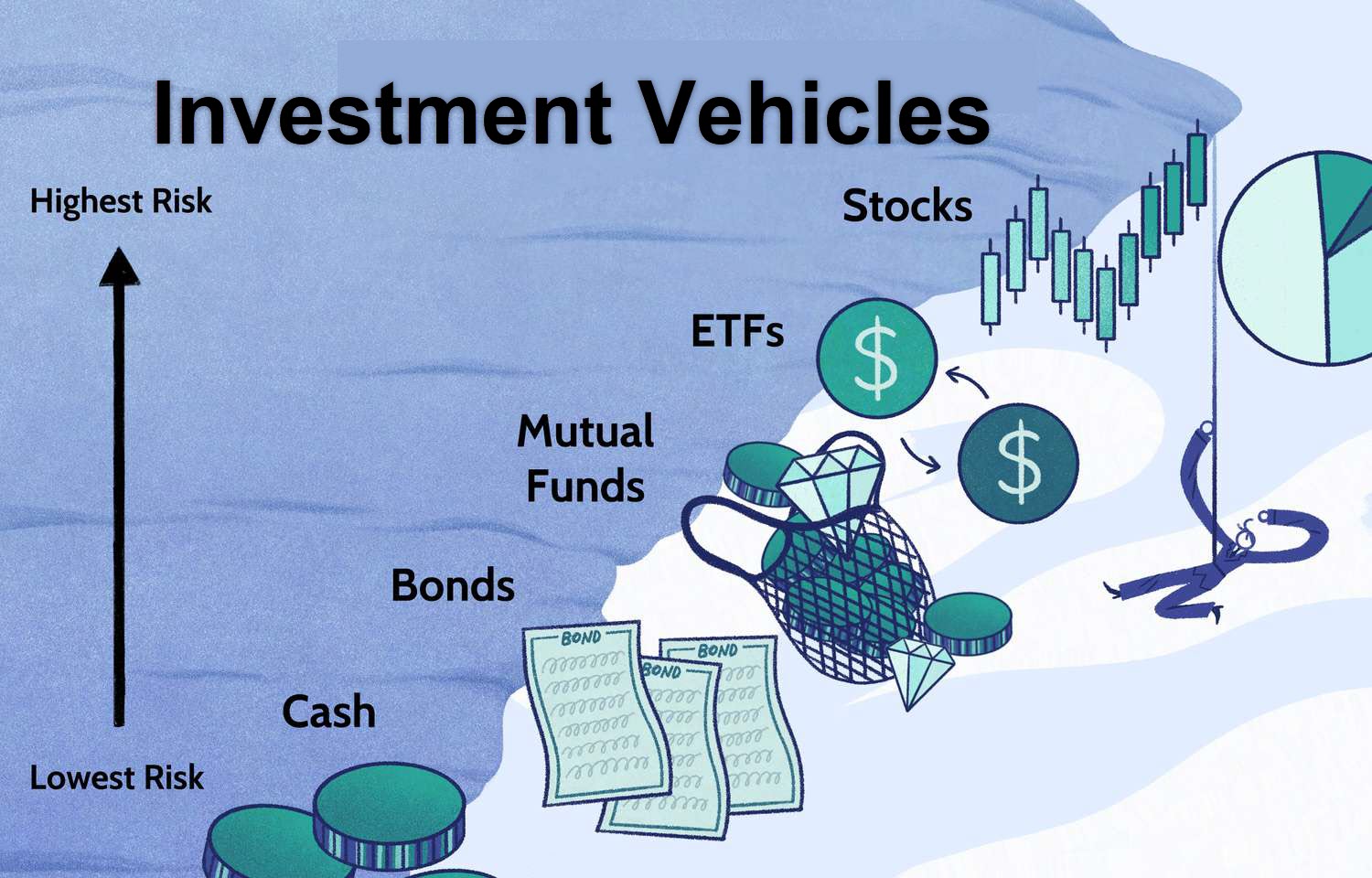

Conclusion: Build Your Portfolio Like a Pyramid, Not a House of Cards

Investing isn’t about chasing the hottest trend or hiding in the safest corner—it’s about balance, intention, and adaptability. The smartest investors build their portfolios like pyramids:

- Base of a pyramid: Stable, low-risk assets like Treasuries, CDs, and high-grade bonds provide a strong foundation.

- Middle of a pyramid: Moderate-growth investments like blue chip stocks, balanced funds, and dividend growers offer steady progress.

- Tip of a pyramid: A small allocation to high-risk, high-reward vehicles—like speculative stocks or futures—adds potential upside without jeopardizing your future.

Throughout this guide, you’ve seen real stories of wins, losses, and lessons learned. From Carlos’s futures fallout to Jen’s cash drag, each example shows that no investment is perfect—but every decision can be improved with the right strategy.

Your Next Steps:

- Audit your current portfolio – Are you overexposed to risk or too conservative for your goals?

- Identify gaps – Do you have enough liquidity? Are you missing inflation protection?

- Make gradual, informed changes – Investing is a marathon, not a sprint.

And remember: your financial journey is uniquely yours. The best portfolio is the one that aligns with your goals, timeline, and risk tolerance—not someone else’s.

Important Disclosures: Retirement “R” Us, a registered retirement planning advisor, provides this information for educational purposes only. It is not intended to offer personalized investment advice or suggest that any discussed securities or services are suitable for any specific investor. Readers should not rely solely on the information provided here when making investment decisions.

- Investing carries risks, including the potential loss of principal. No investment strategy can ensure a profit or protect against loss during market downturns.

- Past performance is not indicative of future results.

- The opinions shared are not meant to serve as investment advice or to predict future performance.

- While we believe the information provided is reliable, we do not guarantee its accuracy or completeness.

- This content is for educational purposes only and is not intended as personalized advice or a guarantee of achieving specific results. Consult your tax and financial advisors before implementing any discussed strategies.

- Everyone’s retirement circumstances, especially when it comes to health insurance and health care, are unique.

- Retirement “R” Us does not provide tax or legal advice. Please consult your tax advisor or attorney for advice tailored to your situation.

Legal Disclaimer: The information provided on this website is for general informational purposes only and is not intended to be legal advice. While we strive to ensure the accuracy and completeness of the information, we make no guarantees regarding its accuracy, completeness, or timeliness. The content is provided “as is” without any warranties of any kind, either express or implied.

Use of this website does not create an attorney-client relationship between the user and the website owner or any of its contributors. Users should not act upon the information provided without seeking professional legal counsel. Any reliance on the information provided is solely at the user’s own risk.

We are not responsible for any errors or omissions, or for any actions taken based on the information provided on this website. Links to third-party websites are provided for convenience only and do not constitute an endorsement or approval of their content. We are not liable for any damages arising from the use of or reliance on the information provided on this website or any linked third-party websites.

By using this website, you agree to the terms of this legal disclaimer. If you do not agree with these terms, please do not use this website.

Leave a Reply