The Power of Compound Interest: Your Path to Financial Growth

Compound interest is often referred to as the eighth wonder of the world, and for good reason. It has the potential to significantly grow your wealth over time, making it a powerful tool for anyone looking to build their financial future. In this blog post, we’ll explore what compound interest is, how it works, and provide some illustrations and examples to help you understand its impact.

What is Compound Interest?

Compound interest is the interest on a loan or deposit that is calculated based on both the initial principal and the accumulated interest from previous periods. Unlike simple interest, which is calculated only on the principal amount, compound interest allows your money to grow at an accelerated rate because you earn interest on your interest.

How Does Compound Interest Work?

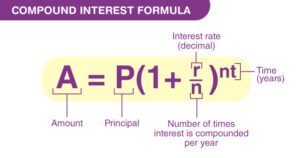

The formula for compound interest is:

Where:

- (A) is the amount of money accumulated after (n) years, including interest.

- (P) is the principal amount (the initial amount of money).

- (r) is the annual interest rate (decimal).

- (n) is the number of times that interest is compounded per year.

- (t) is the time the money is invested or borrowed for, in years.

Illustration of Compound Interest

Let’s illustrate compound interest with an example. Suppose you invest \$1,000 at an annual interest rate of 5%, compounded annually.

- Year 1:

- Principal: $1,000

- Interest: $1,000 * 0.05 = $50

- Total: $1,000 + $50 = $1,050

- Year 2:

- Principal: $1,050

- Interest: $1,050 * 0.05 = $52.50

- Total: $1,050 + $52.50 = $1,102.50

- Year 3:

- Principal: $1,102.50

- Interest: $1,102.50 * 0.05 = $55.13

- Total: $1,102.50 + $55.13 = $1,157.63

As you can see, the interest earned each year increases because it is calculated on the new total, which includes the interest from the previous years.

Once upon a time in the bustling city of Financia, there were two friends, Alex and Jamie. Both were 25 years old and had just started their careers. They were excited about their future and often discussed their dreams and financial goals.

One day, they attended a seminar on personal finance where they learned about the magic of compound interest. The speaker emphasized the importance of investing early to take full advantage of compound interest. Inspired by the seminar, Alex decided to start investing immediately, while Jamie thought it could wait a few years.

Alex’s Journey:

Alex decided to invest $5,000 every year starting at age 25. He planned to continue this until he turned 35, after which he would stop investing but leave his money to grow. Assuming an average annual return of 7%, let’s see how Alex’s investment grows over time:

| Year | Age | Annual Investment | Total Investment | Value at 7% Return |

|---|---|---|---|---|

| 1 | 25 | $5,000 | $5,000 | $5,350 |

| 2 | 26 | $5,000 | $10,000 | $11,045 |

| 3 | 27 | $5,000 | $15,000 | $17,178 |

| 4 | 28 | $5,000 | $20,000 | $23,750 |

| 5 | 29 | $5,000 | $25,000 | $30,773 |

| 6 | 30 | $5,000 | $30,000 | $38,259 |

| 7 | 31 | $5,000 | $35,000 | $46,221 |

| 8 | 32 | $5,000 | $40,000 | $54,674 |

| 9 | 33 | $5,000 | $45,000 | $63,631 |

| 10 | 34 | $5,000 | $50,000 | $73,107 |

| 11 | 35 | $5,000 | $55,000 | $83,118 |

After 10 years, Alex stops investing but leaves his money to grow. By the time he turns 65, his investment would have grown significantly:

| Year | Age | Total Investment | Value at 7% Return |

|---|---|---|---|

| 36 | 36 | $55,000 | $88,936 |

| 46 | 45 | $55,000 | $175,903 |

| 56 | 55 | $55,000 | $348,850 |

| 66 | 65 | $55,000 | $692,764 |

Jamie’s Journey:

Jamie, on the other hand, decided to start investing at age 35. He invested $5,000 every year until he turned 65. Assuming the same average annual return of 7%, let’s see how Jamie’s investment grows over time:

| Year | Age | Annual Investment | Total Investment | Value at 7% Return |

|---|---|---|---|---|

| 1 | 35 | $5,000 | $5,000 | $5,350 |

| 2 | 36 | $5,000 | $10,000 | $11,045 |

| 3 | 37 | $5,000 | $15,000 | $17,178 |

| 4 | 38 | $5,000 | $20,000 | $23,750 |

| 5 | 39 | $5,000 | $25,000 | $30,773 |

| 6 | 40 | $5,000 | $30,000 | $38,259 |

| 7 | 41 | $5,000 | $35,000 | $46,221 |

| 8 | 42 | $5,000 | $40,000 | $54,674 |

| 9 | 43 | $5,000 | $45,000 | $63,631 |

| 10 | 44 | $5,000 | $50,000 | $73,107 |

| 11 | 45 | $5,000 | $55,000 | $83,118 |

| 21 | 55 | $5,000 | $105,000 | $219,745 |

| 31 | 65 | $5,000 | $155,000 | $540,741 |

By the time Jamie turns 65, his investment would have grown to $540,741.

The Lesson:

Despite investing the same amount of money annually, Alex’s early start allowed him to benefit more from compound interest. By starting 10 years earlier and letting his investments grow, Alex ended up with $692,764, while Jamie, who started later, ended up with $540,741.

This story highlights the importance of investing early. The power of compound interest means that the earlier you start, the more your money can grow over time. So, start investing early and let compound interest work its magic!

Important Disclosures: Retirement “R” Us, a registered retirement planning advisor, provides this information for educational purposes only. It is not intended to offer personalized investment advice or suggest that any discussed securities or services are suitable for any specific investor. Readers should not rely solely on the information provided here when making investment decisions.

- Investing carries risks, including the potential loss of principal. No investment strategy can ensure a profit or protect against loss during market downturns.

- Past performance is not indicative of future results.

- The opinions shared are not meant to serve as investment advice or to predict future performance.

- While we believe the information provided is reliable, we do not guarantee its accuracy or completeness.

- This content is for educational purposes only and is not intended as personalized advice or a guarantee of achieving specific results. Consult your tax and financial advisors before implementing any discussed strategies.

- Everyone’s retirement circumstances, especially when it comes to health insurance and health care, are unique.

- Retirement “R” Us does not provide tax or legal advice. Please consult your tax advisor or attorney for advice tailored to your situation.

Legal Disclaimer: The information provided on this website is for general informational purposes only and is not intended to be legal advice. While we strive to ensure the accuracy and completeness of the information, we make no guarantees regarding its accuracy, completeness, or timeliness. The content is provided “as is” without any warranties of any kind, either express or implied.

Use of this website does not create an attorney-client relationship between the user and the website owner or any of its contributors. Users should not act upon the information provided without seeking professional legal counsel. Any reliance on the information provided is solely at the user’s own risk.

We are not responsible for any errors or omissions, or for any actions taken based on the information provided on this website. Links to third-party websites are provided for convenience only and do not constitute an endorsement or approval of their content. We are not liable for any damages arising from the use of or reliance on the information provided on this website or any linked third-party websites.

By using this website, you agree to the terms of this legal disclaimer. If you do not agree with these terms, please do not use this website.

Leave a Reply